On Working as an Independent Contractor and Where Your Money Goes

This post is based on my own business practices, which have been evolving over the last 14+ years providing in-home child care and family support. Each solo business and provider and agency have their own business practices and financial priorities.

What are you paying for when you hire a postpartum doula and newborn care specialist? What are you paying for when you choose a solo business as opposed to an agency?

I’ve hoped at least some of what you’re paying for was revealed in my About Me page that describes my credentials and experience, as well as through my consultations and actual work in-home! 🙂 However, I think it’s been beneficial for me to understand how independent contractors (IC) (e.g., postpartum doulas) and employees (e.g., nannies) have differing scopes and associated required tax responsibilities, so I wanted to provide some transparency on that matter and on some finances in general.

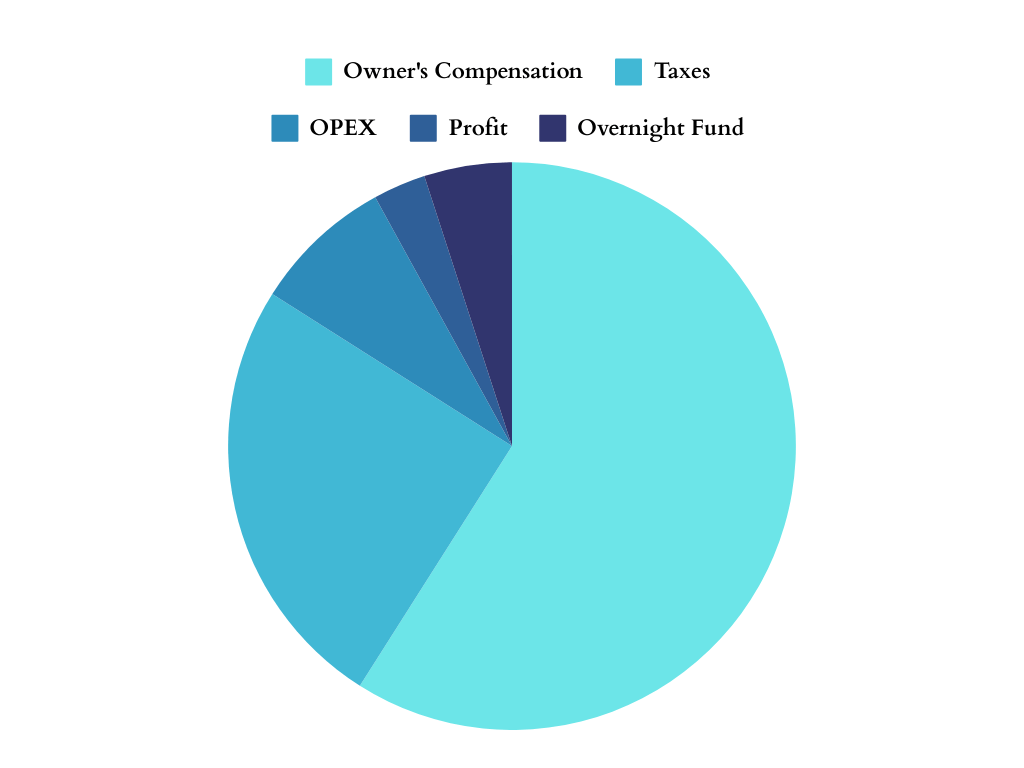

Earlier this year, I started to put all business income through a funnel based on percentages to help me keep business income and expenses more straightforward than how I had done things in the past (make sure to keep your business income and expenses separate, birthworkers!). This method was somewhat inspired by Profit First and You Need a Budget’s envelope system (see additional commentary on Profit First potential pitfalls here). The breakdown looks like this…

This method helps me automatically portion money for things like taxes and the Overnight Fund, but I do give myself some flexibility with changing percentages based on how many clients I have- more clients means I can reduce my owner’s compensation/income and redirect that towards the Overnight Fund! I do however keep the Overnight Fund section at a minimum so that I always contribute to it. This chart and each section’s percentages may change over time as well as I progress in my business and my personal needs change. The terms generally cover the following areas with relevant examples:

Owner’s compensation = Rent, food, health insurance, auto expenses and gas, student loans, etc.

Taxes = Income taxes and self-employment tax

- Self-employment tax = Social Security and Medicare

- Employers typically withhold and pay their own portion, so this is a big difference when you’re self-employed!

- Also on this note, if you’re planning to hire a nanny or a babysitter for work that goes beyond the $2,700 limit for 2024, the IRS website goes into more detail on household employees (“The worker is your employee if you can control not only what work is done, but how it is done.”) and employer’s proper withholding and paying of their share of FICA (i.e., Medicare and social security) taxes and others. Postpartum doulas and some Newborn Care Specialists are still typically considered independent contractors as we do have more “control”: over the “how” portion of the work performed and hours and availability provided. However, this isn’t to say we don’t collaborate with parents on the “how” portion- I always talk with parents about their preferences and needs!

- Employers typically withhold and pay their own portion, so this is a big difference when you’re self-employed!

OPEX (Operating Expenses) = Continuing education, liability insurance, website, office/business supplies, masks, CPR/First Aid certification, some paid and sick leave, some advertising

Profit = Split evenly between Owner’s Distribution (e.g., kind of like a future owner’s compensation) and Business Profit Savings (e.g., more sick/paid leave, more advertising, etc.)

Overnight Fund = I previously linked more information about the fund, but basically this serves in automatically putting aside money to more actively support the fund for families in need of overnight support

Birthworkers, I’d love to hear your own IC insights! What OPEX expenses do you prioritize when work might be slow? Is there a different method than mine that you use to streamline finances?

Parents, I’d also love to hear if you’ve learned something new or other thoughts! Are payroll and taxes something that would affect your family’s childcare decisions?

The Business of Babies and Families (Part 2), Why Working With a Solo Business Can Be Just as or More Beneficial Than an Agency, will go more into depth about what I and agencies both offer and how we’re different. So look out for that post soon!

Leave a reply to Baby Insights: The Business of Babies and Families (Part 2) – Attuned Postpartum Cancel reply